Oliver Inderwildi and Markus Kraft

In recent years, we have strived to enhance our economies while minimising environmental impacts – regrettably, with limited success. Our most recent academic study explores how industry can indeed be economically and environmentally optimised using intelligent computer models. Computational models support our life without us knowing it: they are in the mobile phones we use, guide our next-day delivery and securely process our daily payments. In industry, computational models have enhanced the workings of complex factories and machinery since the 1960s. They improve operational efficiency and increase security for instance by monitoring sensors, optimising energy flows and predicting critical situations. Engine vibration monitoring on airplane provide pilots with information about the efficiency of the engine as well as warnings in case of exceedances and are therefore critical for the security and efficiency of today’s commercial aviation. In case of pipeline systems, vibration and temperature analysis point to size and location of a defect or detonation hazard, again enhancing efficiency while reducing risk. While models are already critical for the efficient and safe operation of technology, they have become both more complex and interconnected, enabling even better predictions. Algorithms are meanwhile able to spot critical patterns in the factors they monitor that likely lead to failure, providing operators with valuable information.

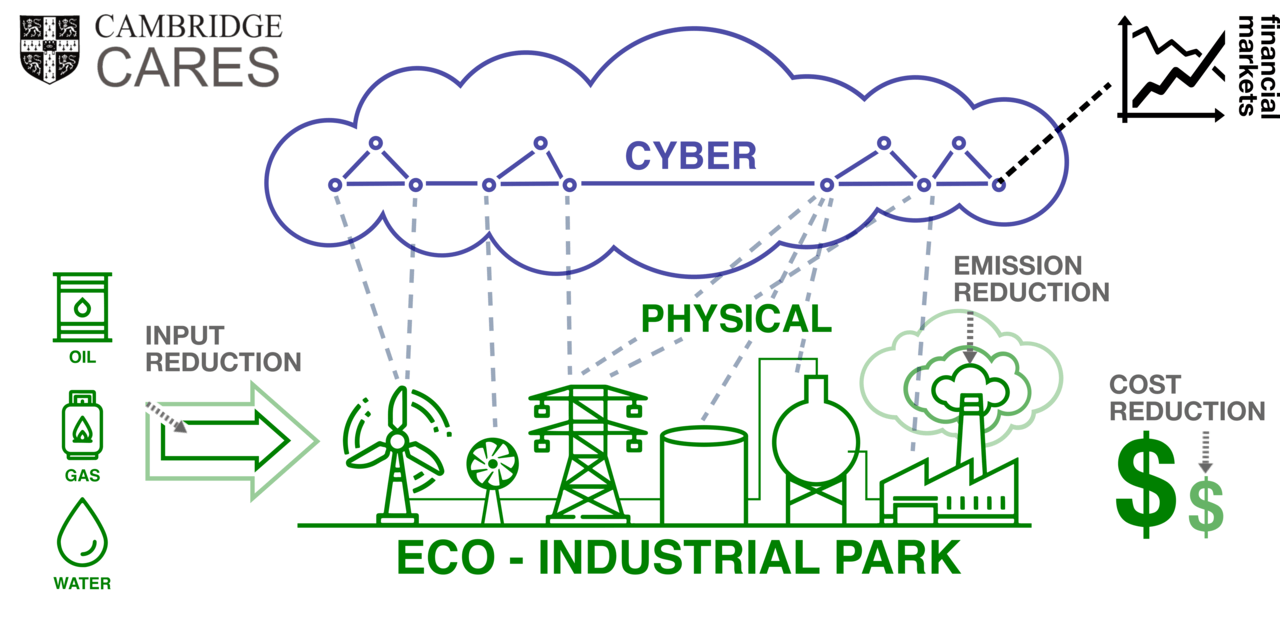

However, computer models not only monitor numerous sensors on large technical systems, but also harness the vast data available on the semantic web. In the financial sector, for instance, algorithmic trading generates profits at speeds and frequencies impossible for human traders. A classic example of such automated trading is the exploitation of minimal discrepancies between different markets, so-called arbitrage. Large banks earn billions using simple algorithms for high-frequency trading! For a human, it is neither possible to monitor an industrial park nor to trade at the speed of algorithmic trading. Smart algorithms can do both and are able to provide human decision makers with superior solutions. For our most recent academic study, we developed an algorithm that analyses financial markets and in parallel utilises a complex model of an eco-industrial park, thus connecting the engineering and financial models – the scheme in the header of this article illustrates the concept.

Results are stunning; combining the financial and the engineering world using advanced, automated algorithms can increase the profitability of industrial production significantly. This form of artificial intelligence utilises commodity future curves – derived from the semantic web – and can indeed anticipate opportunities to increase profits or avoid losses by optimising procurement, production and sale according to prices estimated by financial markets. The scheme above illustrates the functioning of the multi-algorithm model.

Two test cases, the production of methanol from natural gas and biodiesel from palm oil were considered; in the case of the former, profits could be increased by 12% compared to conventional procurement and production, while in the latter case, losses of 11% could be avoided. Extrapolating these savings to the full year, AI is able to completely alter the economic viability of a plant and therefore can turn failing businesses to profitability.

Firstly, checking all production and storage capacities in an eco-industrial park over time and in parallel monitoring the evolution of prices for input and output material on various global markets is simply not feasible for a human being. Here, artificial intelligence in the form of an advanced algorithm can assist a human decision maker by proposing superior solutions, thereby altering economics of the entity. Secondly, AI, unlike humans, does not suffer from the many cognitive biases that prevent our minds from spotting the optimal solution – AI’s Spock-like intelligence develops the most mathematically advantageous scenario thereby circumventing human cognitive biases in the decision making processes. It is of paramount importance that though artificial intelligence supports and enhances human decisions, it must not replace them – humans need to be the ultimate decision makers. The reason for this is that AI could produce an optimal, although unethical, solution.

Our study is only a small step in the direction of industrial processes optimised by AI, but it already demonstrates the scale of opportunities lying ahead, not only for economic but also for environmental improvements.

What’s to come? A subsequent study will explore how industry can efficiently and automatically hedge against other risks such as currency risks. Industry can thereby benefit rather than suffer from volatility and thus increase its inherent anti-fragility.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The original academic paper “Enhanced Procurement and Production Strategies for Chemical Plants: Utilizing Real-Time Financial Data and Advanced Algorithms” by Janusz Sikorski et al was published in Industrial & Engineering Chemical Research and can be retrieved here.